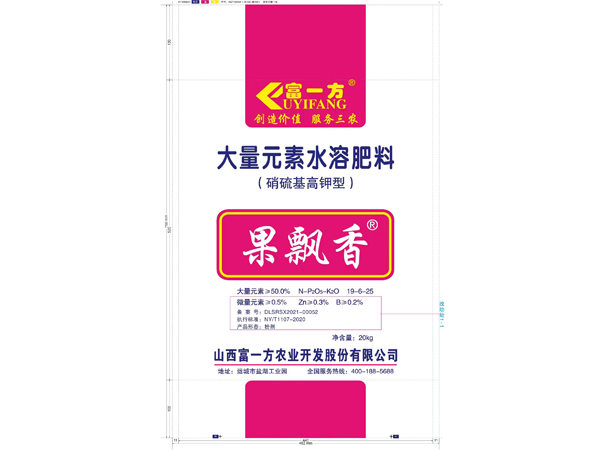

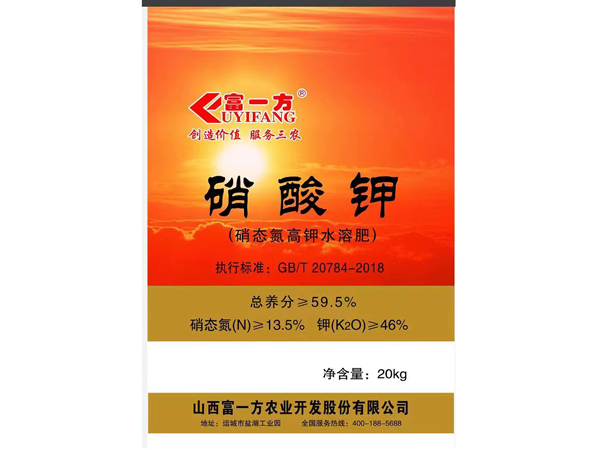

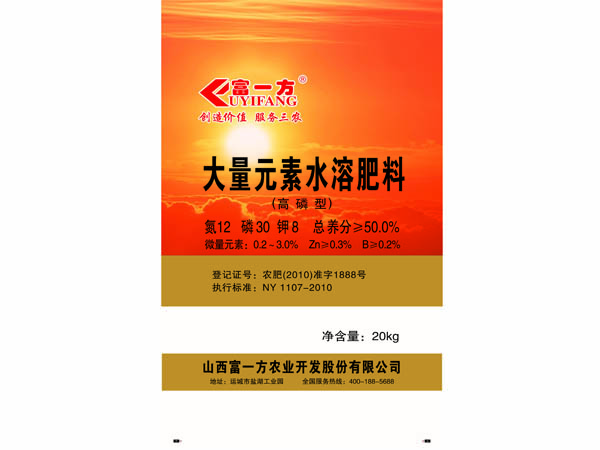

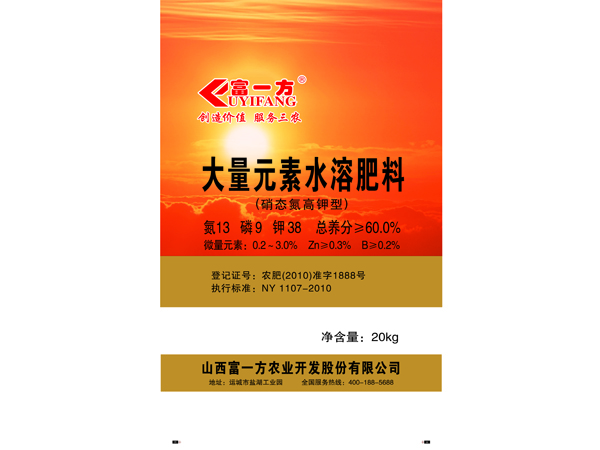

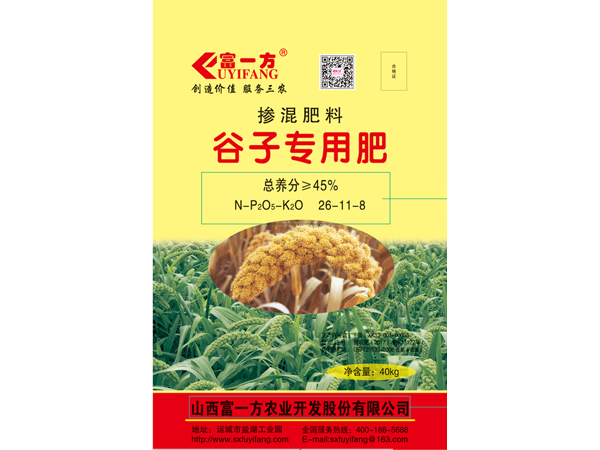

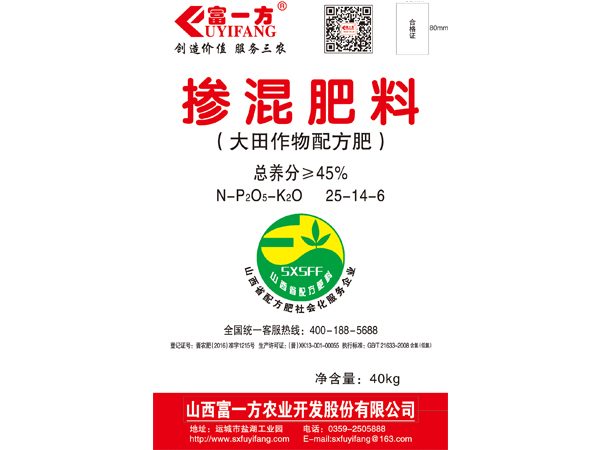

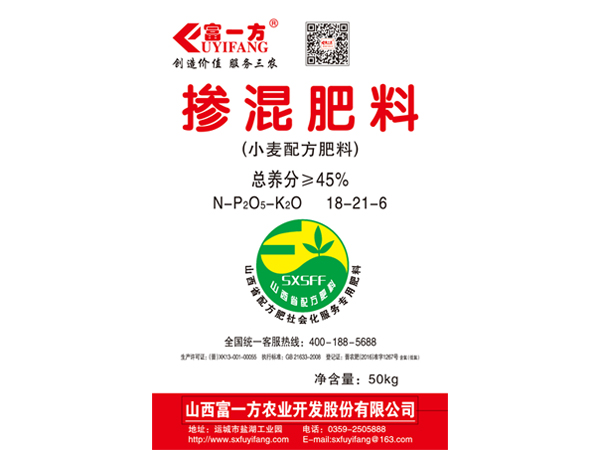

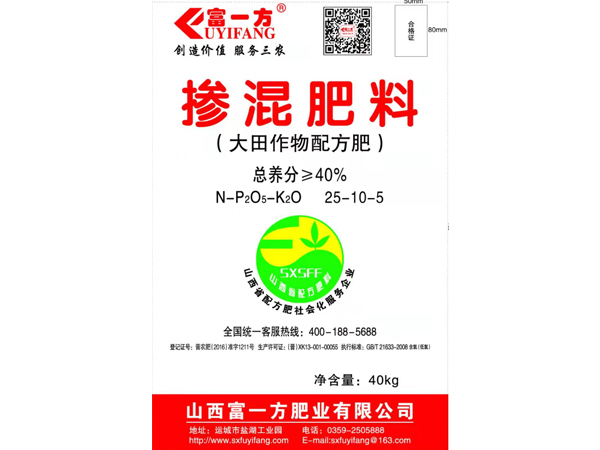

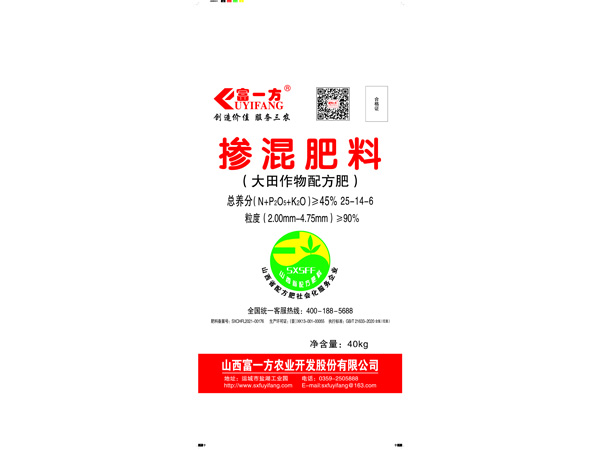

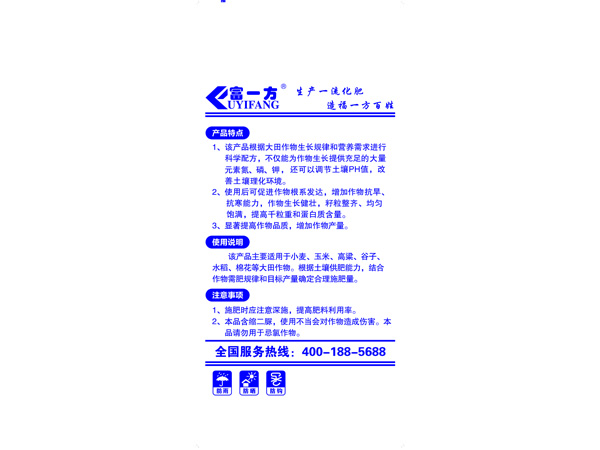

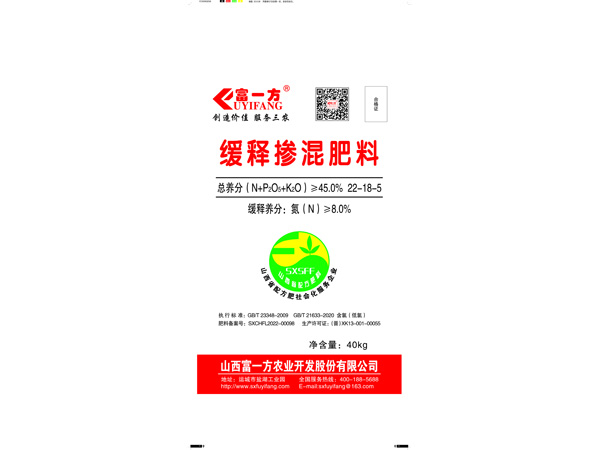

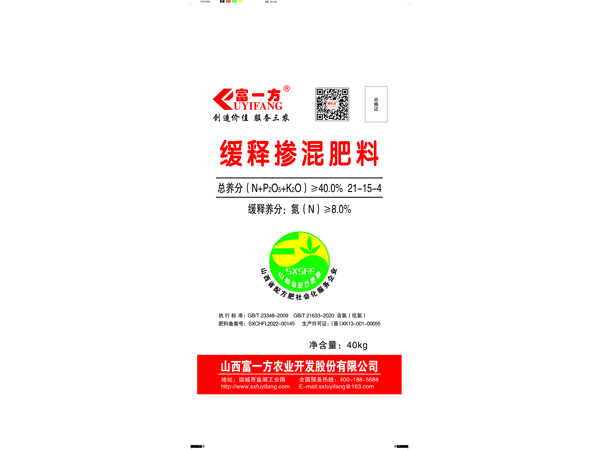

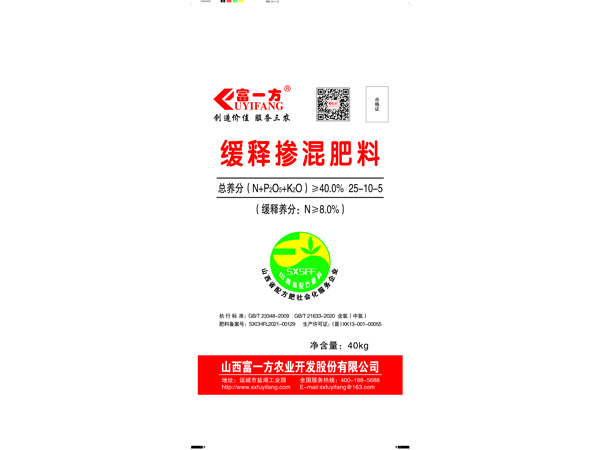

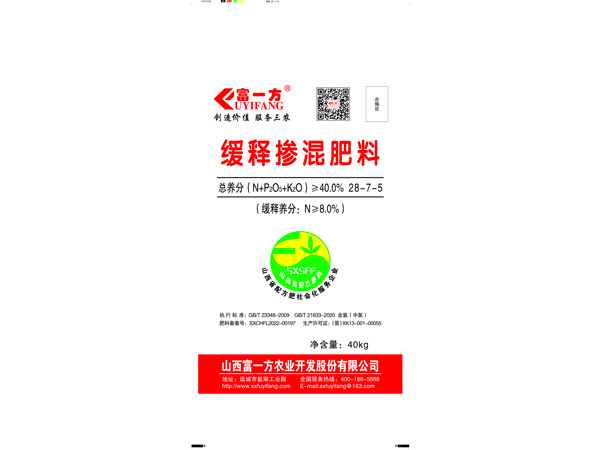

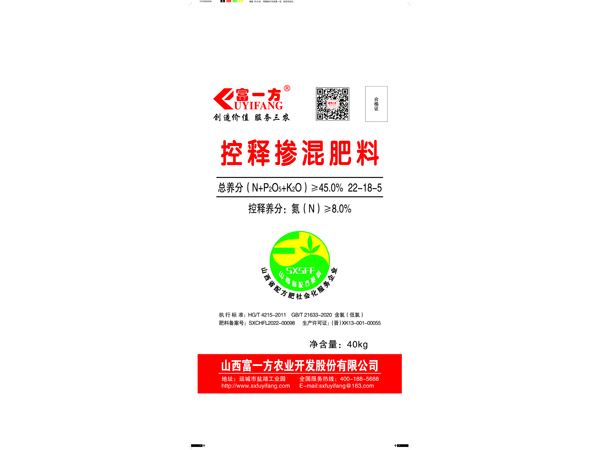

产品中心

PRODUCT CENTER

公司简介 ABOUT US

——————————————

山西富一方农业开发-pjh5886葡京会(vip认证)-百度百科

山西富一方农业开发-pjh5886葡京会(vip认证)-百度百科位于运城市盐湖工业园复旦大道东段,占地面积58.71亩。注册资本1500万元。现有技术人员15名,职工50名。 公司自2005年成立以来,一直致力于测土配方施肥的研发与生产,拥有全自动化电脑配料掺混肥料现代化成套设备,年设计生产规模为10万吨。主要生产小麦、玉米、果树等各种测土配方专用肥料。根据农业部《配方肥料》行业标准,是山西省一家登记《配方肥料》的测土配方施肥生产企业。 企业组织机构健全,设有研发中心、质检科、生产科、办公室、财务部、后勤部、推广销售科、示范基地等部门;生产设施、设备齐全,建有办公区、综合生产车间、原料库区、成品库区等。

0

成立16余载

0

15个技术人员

0

50名职工

0

年生产规模10万+吨

联系我们

CONTACT US

山西富一方农业开发-pjh5886葡京会(vip认证)-百度百科

免费热线:400-188-5688

诚招代理电话:19803595888

联系人:苏治中

联系电话:19803595888

邮箱:sxfuyifang@163.com

地址:山西省运城市盐湖区工业园复旦大道

免费热线:400-188-5688

诚招代理电话:19803595888

联系人:苏治中

联系电话:19803595888

邮箱:sxfuyifang@163.com

地址:山西省运城市盐湖区工业园复旦大道

版权所有:山西富一方农业开发-pjh5886葡京会(vip认证)-百度百科 备案号:晋ICP备11007348号-3 技术支持 - 龙采科技集团